The decentralized internet, or Web3, is rapidly moving from a niche concept to a mainstream force, reshaping industries and creating new economic paradigms. For individuals in Vietnam, this evolution presents a landscape rich with opportunity. However, navigating this new terrain without a clear plan is like sailing without a compass. A well-defined Web3 strategy is no longer just for businesses; it is an essential tool for anyone looking to invest, participate, or simply understand the future of digital interaction.

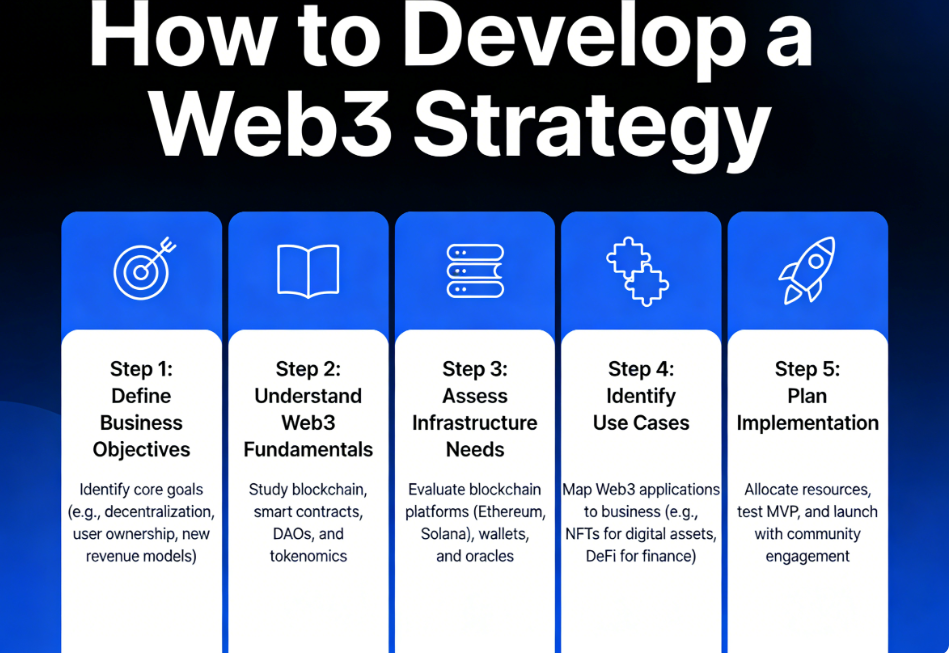

Developing a robust Web3 strategy will empower you to make informed decisions, manage risk, and effectively capitalize on the growth of decentralized technologies. This guide provides a practical, step-by-step framework to help you build a personalized Web3 strategy. We will cover everything from setting clear objectives to executing advanced investment techniques, ensuring you are prepared to engage with this technological revolution confidently and successfully.

What is a Web3 Strategy and Why Do You Need One?

A Web3 strategy is a comprehensive plan that outlines how you will interact with the decentralized ecosystem to achieve specific goals. It is a roadmap that guides your decisions regarding investments, technology adoption, and participation in Web3 protocols. This strategy is not a one-size-fits-all document; it should be tailored to your individual circumstances, including your financial goals, risk tolerance, and level of expertise.

The need for a strategy stems from the unique nature of the Web3 space. It is characterized by high volatility, rapid innovation, and a constant influx of new projects. Without a guiding strategy, it is easy to get caught up in hype cycles, make emotional decisions, or fall victim to scams. A clear strategy helps you:

- Define Your Objectives: Are you looking for long-term growth, passive income, or active participation in new technologies? Your strategy starts with defining what success looks like for you.

- Manage Risk: By setting clear rules for diversification, position sizing, and security, you can protect your capital from significant losses.

- Maintain Discipline: A strategy prevents you from making impulsive trades based on market sentiment (FOMO or FUD). It provides a logical framework for your actions.

- Identify Opportunities: A strategic approach allows you to systematically research and identify promising projects that align with your long-term vision, rather than chasing short-term trends.

For both newcomers and seasoned investors in Vietnam, a well-crafted Web3 strategy is the key to turning the immense potential of this new internet era into tangible results.

Step 1: Define Your Goals and Risk Tolerance

The foundation of any successful strategy is a clear understanding of what you want to achieve and how much risk you are willing to take. Your goals will dictate your entire approach, from the assets you choose to the platforms you use.

Set Clear, Measurable Objectives

Start by asking yourself what you want to accomplish in the Web3 space. Your goals should be specific and, if possible, measurable. Examples include:

- Long-Term Capital Appreciation: Aiming to grow your portfolio over a 5-10 year period by investing in foundational Web3 infrastructure.

- Passive Income Generation: Targeting a specific monthly or annual return through staking, lending, or yield farming.

- Active Trading Profits: Seeking to generate short-term profits by actively trading cryptocurrencies based on market analysis.

- Technology Exploration: Focusing on learning and experimenting with new dApps, NFTs, and DAOs, with financial return as a secondary objective.

A Web3 strategy for crypto beginners might start with the simple goal of purchasing and securely holding a small amount of Bitcoin and Ethereum to learn the basics. In contrast, a strategy for seasoned investors could involve complex DeFi yield farming across multiple blockchains.

Assess Your Risk Tolerance

Web3 is a high-risk, high-reward environment. A frank assessment of your risk tolerance is crucial. Consider:

- Financial Situation: How much capital can you afford to lose without impacting your financial stability? This is often called your "risk capital."

- Time Horizon: A longer time horizon generally allows you to take on more risk, as you have more time to recover from market downturns.

- Emotional Resilience: How will you react if your portfolio drops 50% in a week? The ability to remain calm and stick to your strategy during periods of extreme volatility is a key trait of successful investors.

Your risk tolerance will determine your asset allocation. A low-risk strategy might allocate a majority of capital to established assets like Bitcoin, while a high-risk strategy might focus more on emerging altcoins and NFTs.

Step 2: Conduct Foundational Research (DYOR)

The mantra of the crypto world is "Do Your Own Research" (DYOR). A successful Web3 strategy is built on a deep and ongoing understanding of the ecosystem. This research should be systematic and cover several key areas.

Macro-Level Trend Analysis

Start by understanding the big picture. Identify the major trends and narratives shaping the Web3 landscape. Key areas to watch include:

- Layer 1 Competition: Which blockchains are gaining traction in terms of developer activity, user growth, and transaction volume?

- Layer 2 Scaling Solutions: How are scaling solutions evolving to make blockchains faster and cheaper?

- DeFi Innovation: What new financial primitives are emerging? Look at trends like liquid staking, decentralized derivatives, and real-world asset (RWA) tokenization.

- NFT and Metaverse Utility: How are NFTs evolving from simple collectibles to assets with real-world utility and integration into metaverse platforms?

- Regulatory Environment: Stay informed about global and local regulatory developments, especially those affecting how to invest in Web3 in Vietnam.

Project-Specific Due Diligence

Once you identify a promising sector, dive deep into individual projects. A thorough analysis should include:

- The Whitepaper: This is the project's foundational document. It should clearly explain the problem it solves, the technology it uses, and its vision for the future.

- The Team: Investigate the founders and developers. Do they have relevant experience and a track record of success? Are they transparent and actively engaged with the community?

- Tokenomics: This is the economics of the project's token. Analyze the total supply, distribution, and utility of the token. A well-designed tokenomics model aligns the incentives of the team, investors, and users.

- Community and Ecosystem: A vibrant and active community is a strong indicator of a project's health. Check their social media channels, Discord, and forums. Look for a growing ecosystem of dApps and partners building on the platform.

Secure and reliable platforms are crucial for executing your research into tangible investments. For traders in Vietnam, HIBT offers access to a diverse range of digital assets, from established leaders to promising new projects, backed by comprehensive market data to support your research process.

Step 3: Formulate Your Asset Allocation and Portfolio Construction

With your goals defined and research completed, it's time to build your portfolio. Asset allocation is the process of deciding how to distribute your investment capital across different types of assets.

The Core-Satellite Approach

A popular and effective method for portfolio construction is the Core-Satellite model.

- The Core (60-80% of portfolio): This portion is invested in established, lower-risk assets that provide a stable foundation. In Web3, this typically includes Bitcoin (BTC) and Ethereum (ETH). These assets have proven track records, high liquidity, and are widely regarded as the cornerstones of the digital economy.

- The Satellites (20-40% of portfolio): This portion is allocated to higher-risk, higher-reward assets. These can be further diversified across different sectors based on your research and convictions.

Building Your Satellites

Your satellite portfolio is where you can express your specific investment theses. You might allocate capital to:

- Promising Layer 1s: Tokens of alternative smart contract platforms you believe have the potential to challenge Ethereum's dominance.

- DeFi Blue Chips: Governance tokens of leading DeFi protocols with strong revenue models and large user bases.

- GameFi and Metaverse Tokens: Investments in the infrastructure and currencies of emerging virtual worlds and blockchain games.

- Speculative Plays: A small allocation (e.g., 1-5% of your total portfolio) to very high-risk micro-cap projects or NFTs that have the potential for exponential returns (but also a high chance of failure).

This structured approach ensures that your portfolio is anchored by stable assets while still providing exposure to the explosive growth potential of emerging Web3 sectors.

Step 4: Choose Your Execution Venues and Tools

Your strategy is only as good as your ability to execute it. This requires choosing the right platforms and tools for acquiring, managing, and securing your assets.

Centralized vs. Decentralized Exchanges

You will likely need to use both types of exchanges.

- Centralized Exchanges (CEXs): These are the primary on-ramps for converting fiat currency into crypto. Platforms like HIBT are essential for beginners and seasoned traders alike, offering a secure, user-friendly interface, high liquidity, and a wide range of trading pairs. Their robust security and 24/7 customer support provide a safe environment for executing the core of your trading strategy.

- Decentralized Exchanges (DEXs): These allow you to trade directly from your self-custody wallet, providing access to a wider range of new and emerging tokens not yet listed on CEXs.

Wallets and Security

As discussed, security is paramount. Your strategy must include a clear plan for asset custody.

- Use hardware wallets for long-term holdings (your "cold storage").

- Use software wallets for interacting with dApps, but only keep smaller, "spending" amounts in them.

- Implement strong operational security: use unique passwords, enable two-factor authentication (2FA), and be vigilant against phishing scams.

Case Study: A Beginner's First Web3 Strategy

Linh, a university student in Da Nang, is new to crypto. Her Web3 strategy for crypto beginners is focused on education and low-risk accumulation.

- Goal: To invest a small, fixed amount each month to build a long-term portfolio and learn about the technology.

- Risk Tolerance: Very low. She is only investing money she is fully prepared to lose.

- Strategy: She decides to use a Dollar-Cost Averaging (DCA) strategy. Every month, she will buy $50 worth of crypto, regardless of the price.

- Asset Allocation: Her allocation is 70% Bitcoin and 30% Ethereum.

- Execution: She uses HIBT to buy her BTC and ETH each month because of its simple interface and trusted reputation in Vietnam. After every three months of purchases, she transfers the accumulated crypto to her hardware wallet for secure, long-term storage.

This simple yet effective strategy allows Linh to build a position in the market over time while minimizing risk and mastering the fundamentals of self-custody.

Step 5: Implement and Monitor Your Strategy

Execution is an ongoing process. Once your portfolio is constructed, you need to actively monitor its performance and the broader market.

Tracking Your Portfolio

Use portfolio tracking tools to get a consolidated view of all your assets across different wallets and exchanges. This allows you to monitor your overall performance and see how your allocation is changing as market prices fluctuate.

Rebalancing

Rebalancing is the process of periodically buying or selling assets to restore your original target asset allocation. For example, if a bull run in Ethereum causes its weight in your portfolio to increase from 30% to 50%, you would sell some ETH and buy other assets to return to your 30% target.

Your strategy should define how and when you will rebalance. A common approach is to rebalance on a fixed schedule (e.g., quarterly) or when allocations deviate by a certain percentage (e.g., 5%). Rebalancing forces you to take profits from assets that have performed well and buy assets that are relatively undervalued, enforcing a "buy low, sell high" discipline.

Case Study: An Advanced DeFi Strategy

Tuan is a seasoned investor in Hanoi with a high risk tolerance. His Web3 strategy for seasoned investors is focused on generating high yields through DeFi.

- Goal: To achieve a 20% annualized return on his DeFi portfolio.

- Strategy: He researches and identifies several "yield farming" opportunities across Ethereum and Solana. His strategy involves providing liquidity to decentralized exchanges and staking the resulting LP tokens in a yield aggregator to compound his rewards.

- Execution: He uses his hardware wallet with MetaMask to interact with the DeFi protocols. He splits his capital across 3-4 different protocols to diversify his risk of smart contract failure.

- Monitoring: He uses a DeFi portfolio dashboard to track his positions and yields daily. He has set a rule to exit a position immediately if the protocol's TVL drops by more than 30% in a week, as this could signal a loss of confidence in the project.

This advanced strategy requires significant expertise and active management, but it demonstrates how a clear plan can be used to leverage the most innovative aspects of Web3.

Conclusion

Developing a Web3 strategy is the most critical step you can take to succeed in the world of decentralized technology. It transforms you from a passive speculator into a disciplined investor. By setting clear goals, conducting thorough research, building a structured portfolio, and implementing a disciplined execution plan, you can navigate the complexities of the Web3 market with confidence.

The journey into Web3 is a marathon, not a sprint. Your strategy will need to evolve as the technology matures and your own knowledge grows. Stay curious, remain disciplined, and prioritize security above all else. For users in Vietnam ready to embark on this journey, a trusted and secure platform is your most valuable ally. With its user-friendly interface and commitment to security, HIBT provides the ideal foundation for building and executing your Web3 strategy, empowering you to unlock the future of finance.

About the Author

Dr. Anh Tran is a leading cryptographer and an expert in decentralized systems theory. With a portfolio of over 75 published papers in premier blockchain and cybersecurity journals, her work has been instrumental in shaping modern smart contract security standards. Dr. Tran has led the security audits for several of the largest and most complex DeFi protocols, safeguarding billions in user assets. She is a fervent advocate for building a more equitable financial system through technology and is dedicated to educating a new generation of Web3 users.